WHY ALTERNATIVE BUSINESS FINANCING?

“The U.S. Small Business Administration defines a small business loan as a loan of $1 million or less. It calls a loan of less than $100,000 a “micro” loan. But most small businesses need far less than even micro. They might need $10,000 for new equipment or $40,000 for new inventory. With their costly overhead, document-intensive processes and collateral requirements, loans that small are a non-starter for banks.”

“It’s not surprising that small businesses have found another way: alternative finance and, more specifically, alternative finance delivered over the Web.”

Says Stephen Sheinbaum, contributor to Entrepreneur, “Money Talks: Alternative Financing Might Be Right for Your Business.” Read more…

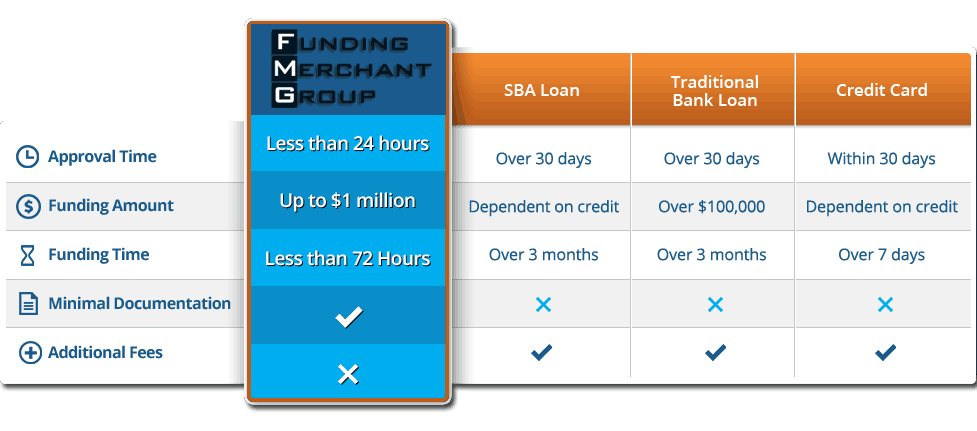

QUICK APPROVAL & QUICK FUNDING

GET APPROVED IN AS LITTLE AS 24 HOURS!